Lease Accounting Implementation and Compliance | New Orleans, LA

Overcome the compliance challenge before year-end.ASC 842 Lease Accounting Standard Implementation – New Orleans, LA

The new accounting rules are designed to provide increased clarity about leases and prevent misrepresentation of the impact on a company’s financial position. In addition, the changes ensure alignment with International Financial Reporting Standard (IFRS) practices and the new Revenue Recognition Standard (ASC 606).

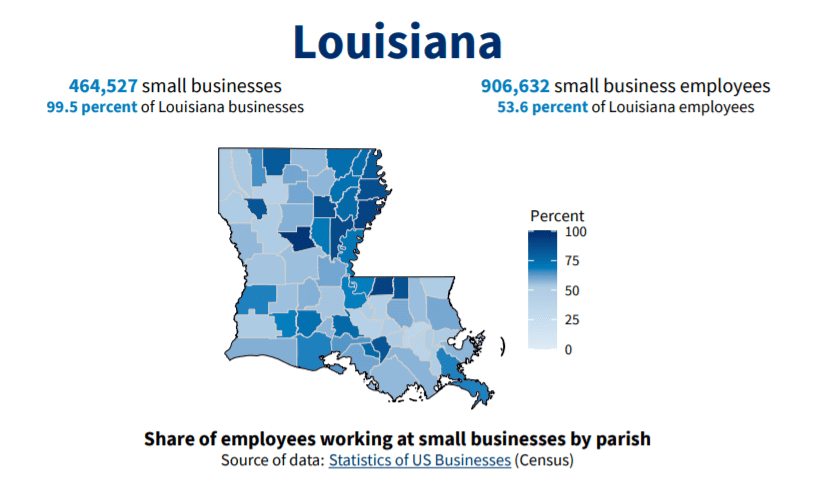

Louisiana Small Business Profile

New Orleans Lease Standard Implementation Services

- Determine the impact on your debt covenant or other calculations and lead discussions with the primary users of your financial statements and other stakeholders as necessary.

- Assist with identifying the lease population, ensuring completeness, and accumulating all executed agreements and amendments.

- Populate the lease accounting model and calculate the right of use asset and a lease liability.

- Provide guidance on significant judgmental assumptions inherent in the calculations.

- Lead and facilitate training for your employees.

- Review the implementation journal entries and advise on recurring entries to be recorded post-implementation to ensure accuracy.

- Assist with the maintenance of the model for new leases, amendments, terminations, etc.

- Advise as necessary on technical lease accounting matters, including modifications, amendments, expansions, tenant improvement allowances, etc.

- Assist with drafting the required footnote disclosures for the financial statements for the year ended December 31, 2022.

New Orleans ASC 842 Experience

Moore Colson, an Atlanta-based CPA firm, provides lease accounting implementation and compliance services to companies in Louisiana. Our team members have significant experience helping management tackle the challenge of compliance – from lease identification through financial reporting changes. Our practical experience allows us to navigate the complexities of implementation, make the correct calculations and convey the impact on financial statements, disclosures, debt covenant calculations, and other financial metrics.

Map of New Orleans (LA)

National Reach

Moore Colson also offers lease accounting compliance and consulting services to companies in New Orleans (LA), Little Rock (AR), Birmingham (AL), Jackson (MS), Jacksonville (FL), Nashville (TN), Charlotte (NC), Charleston (SC), and Atlanta (GA).

Contact Our New Orleans Lease Accounting Team

Moore Colson provides lease accounting implementation and compliance to companies in New Orleans and across Louisiana. If you are interested in learning how we can assist your organization, complete the form below and a team member will follow up with you promptly.