This article was originally published in the Summer 2019 edition of the Georgia Motor Trucking Association (GMTA)‘s magazine, TRUX.

By Chris Arnone, Joe Coleman and Steven Murphy

Not since the 1980s have trucking companies and drivers been faced with sweeping tax law changes similar to those enacted by the Tax Cuts and Jobs Act (TCJA). Effective for the 2018 tax year, companies, drivers and owner-operators filing their tax returns for the first time under TCJA are searching for answers, as well as opportunities, in a few key areas impacting driver compensation and after-tax cash flow.

Driver Per Diem Allowances – What’s all the confusion?

The new tax law’s impact on per diems is one of the most common areas on which we receive questions from our trucking clients. Per diem allowances of up to $66 per day can be paid to company drivers to cover lodging, meals and incidental expenses while the driver is away from home overnight. In order for a company to deduct per diem payments, the payments must be made pursuant to an accountable plan. An accountable plan is a reimbursement/expense allowance arrangement which requires employees to substantiate their expenses and return any unsubstantiated or unused advances. Per diem payments at or below $66 per day are nontaxable to the employee. Companies can pay more or less than this amount, but any amount over $66 per day is treated as taxable wages to the driver. Trucking companies can deduct 80 percent of per diem payments. Per diem payments are not considered taxable wages, so they are excluded from the employee’s wage income and are not subject to FICA, Medicare or income tax withholding.

While some companies already pay per diem to their drivers, the potential tax savings for drivers may help retain existing drivers as well as make the company more attractive to prospective drivers in the recruiting process.

Before the new tax law, company drivers who did not receive a per diem could deduct 80 percent of the maximum daily per diem of $66 per day as an itemized deduction on their tax return. For example, a driver on the road 250 days per year who did not receive any per diem from his or her company could have deducted up to $13,200 (250 days × $66/day × 80%) as a miscellaneous itemized deduction for unreimbursed business expenses. In the scenario where the driver received a per diem from the company that was less than the maximum daily rate, the driver could then deduct 80 percent of the difference. However, the new tax law has eliminated this deduction for company drivers. Depending on the driver’s individual tax situation, the other benefits of the new tax law, namely the increased standard deduction ($12,000 for individuals and $24,000 for married filing jointly), may not offset the loss of the per diem deduction. This has become an eye-opening issue for many company drivers filing their 2018 tax returns.

An opportunity for trucking companies?

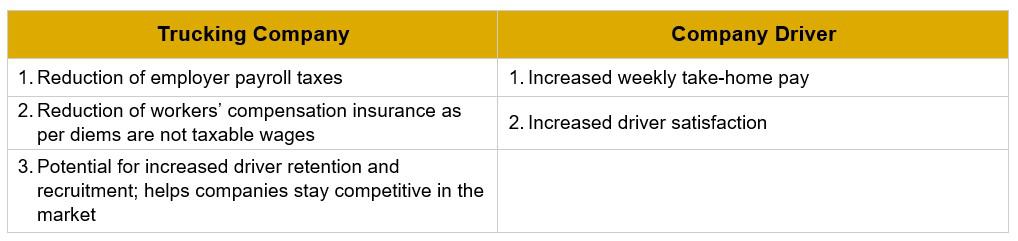

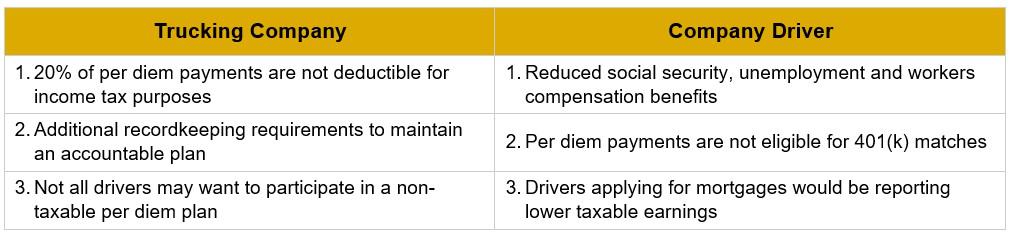

Trucking companies are presented with an opportunity to revisit this important driver benefit issue moving forward, as they could choose to offer up to the maximum per diem of $66 per day as a pre-tax benefit to company drivers. While some companies already pay per diem to their drivers, the potential tax savings for drivers may help retain existing drivers as well as make the company more attractive to prospective drivers in the recruiting process. As most trucking companies pay drivers on a cents-per-mile basis, a portion of the standard pay per mile would be converted to a non-taxable per diem. The chart shows some key advantages, as well as some potential disadvantages, to be considered by companies and drivers related to a non-taxable per diem plan:

Advantages of a non-taxable per diem plan

Disadvantages of a non-taxable per diem plan

What about owner-operators?

Much confusion has also spread over whether owner-operators could continue to qualify for the per diem deduction. Owner-operators will be pleased to learn that they can still deduct 80 percent of the per diem rate, which is set by the Internal Revenue Service. For an owner-operator on the road 250 days a year, this would be a deduction of $13,200 (250 days × $66/day × 80%). So, in summary, while the company driver lost the ability to deduct the per diem, nothing has changed for the owner-operator.

Are more companies exploring an owner-operator model?

To quote a long-standing trucking company client: “If this company never had to purchase another truck we’d be very happy about it.” While the client may have been a bit dramatic, the pressure of increased truck prices, driver pay, insurance and regulatory costs can take a toll on even the most experienced and successful trucking companies. So while many trucking companies have been hesitant to consider adding owner-operators to their fleets due to safety and liability concerns, some companies are now reconsidering their positions. For example, experienced drivers with a good safety history and an entrepreneurial mindset may welcome the opportunity to become an owner-operator. In addition to retaining the per diem deduction, an owner-operator may be able to qualify for the new qualified business income deduction which provides for a tax write-off of 20 percent of their business income. Also, should an owner-operator purchase a used truck, the generous new bonus depreciation rules now provide for a 100 percent deduction for the purchase of used equipment.

The bottom line

The driver shortage continues to be the number one issue facing the trucking industry, and the cost of driver recruiting and turnover has risen to be one of the top expenses. Trucking companies may have an opportunity to set themselves apart from the competition by making some strategic changes in the way they compensate drivers. Could an increase in your drivers’ bottom line help your company?

About The Georgia Motor Trucking Association (GMTA)

The GMTA is the only organization in Georgia that provides full-time service and representation for the trucking industry. The Association serves as the “voice” of the trucking industry in Georgia, representing more than 400 for-hire carriers, 400 private carriers, and 300 associate members.

The mission of the GMTA is to work to make Georgia the best state in the nation in which to base and operate a trucking company. To that end, GMTA seeks to promote, reasonable laws; even-handed, common sense administration; equitable and competitive fees and taxes; a market, political and social environment favorable to the trucking industry; and good citizenship among the people and companies of Georgia’s trucking industry. Learn more about the GMTA here.