Do You Need SOC Reports From Your Vendors? 3 Steps to Consider

Your business relies on third-party vendors. They handle payroll, store customer data or manage your cloud infrastructure. The question is simple: How do you know they're doing it securely and in line with their contractual obligations?

System and Organization Controls (SOC) reports provide that answer. They're independent audits that verify a vendor's controls actually work. But here's the thing: Not every vendor needs one. Requesting SOC reports takes time and resources. The key is knowing when they're essential.

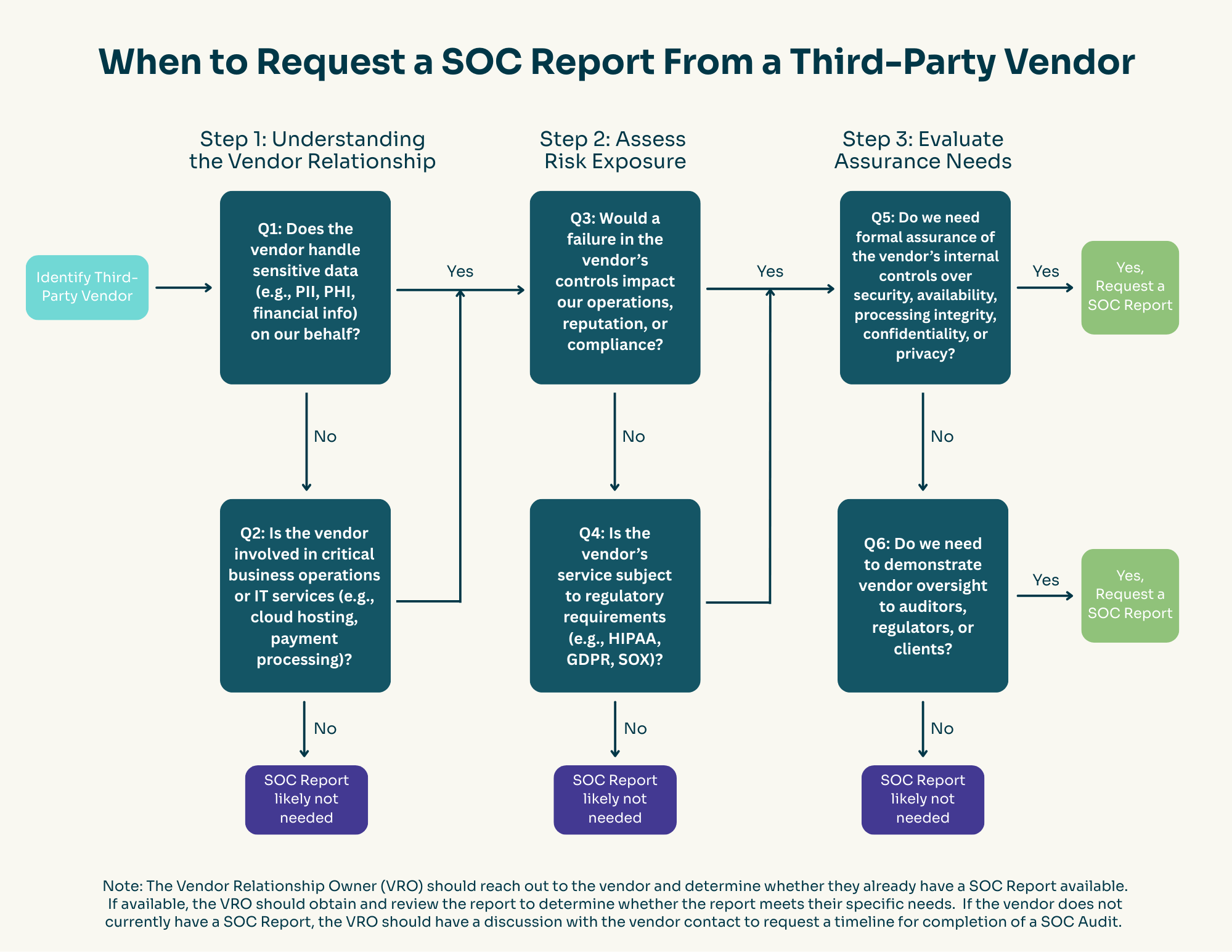

The decision comes down to three factors: your vendor relationship, your risk exposure and your assurance needs. Let’s break it down.

STEP 1: UNDERSTANDING THE VENDOR RELATIONSHIP

The first step in determining whether to request a SOC report involves understanding exactly what role the vendor plays in your operations.

Start by asking whether the vendor handles sensitive data on your behalf. This includes personally identifiable information, protected health information or financial data. Vendors processing credit card transactions, storing customer records or managing employee information typically fall into this category.

Equally important is whether the vendor supports critical business operations or IT services.

Cloud hosting providers, payment processors and core system administrators often qualify as critical vendors. If their services went offline tomorrow, would your business grind to a halt? That's a strong indicator that deeper scrutiny is warranted.

STEP 2: ASSESSING RISK EXPOSURE

Even vendors handling sensitive data may not require a SOC report if the risk they pose is minimal.

The key question centers on impact: Would failure in the vendor's controls significantly affect your operations, reputation or compliance posture?

Consider the ripple effects. A breach at a vendor managing customer data could trigger notification requirements, regulatory penalties and lasting reputational damage. A failure at a critical infrastructure provider could halt operations for days or weeks.

If the potential consequences are severe, a SOC report provides independent verification that the vendor maintains appropriate controls. If the impact would be minimal or easily contained, other forms of vendor oversight may suffice.

STEP 3: EVALUATING ASSURANCE NEEDS

The final determination often comes down to regulatory requirements and stakeholder expectations.

Certain vendor relationships fall under specific regulatory frameworks. Healthcare organizations must ensure vendors comply with HIPAA requirements. Public companies face Sarbanes-Oxley (SOX) obligations. Companies serving European customers must consider GDPR implications. When regulations explicitly require vendor oversight, SOC reports offer standardized evidence of compliance.

Beyond regulatory mandates, organizations must consider whether they need formal assurance of vendor controls over security, availability, processing integrity, confidentiality or privacy. SOC 2 reports specifically address these trust service criteria, providing detailed information about how vendors protect systems and data.

Finally, external stakeholders often drive the need for SOC reports.

Auditors reviewing your internal controls will want evidence of vendor oversight. Regulators may request documentation during examinations. Enterprise clients may demand proof that your vendors meet security standards before signing contracts.

TAKING ACTION

Once you've determined whether a SOC report is necessary, the vendor relationship owner should contact the vendor to check whether they already maintain current SOC reporting.

Many established service providers already undergo regular SOC audits and can provide reports to clients under nondisclosure agreements. Review any existing reports carefully to ensure they cover the specific services and controls relevant to your relationship.

If the vendor doesn't currently have a SOC report, discuss timelines for completion. Recognize that SOC audits require significant investment in time and resources. Vendors may need six months to a year to prepare for and complete an initial audit, particularly if they haven't previously undergone the process.

For vendors who are unwilling or unable to provide SOC reports, consider whether alternative assurances meet your needs. Some organizations accept detailed questionnaires, on-site assessments or other certifications.

In cases where the risk is high and alternatives are insufficient; you may need to reconsider the vendor relationship entirely.

THE BOTTOM LINE

Not every vendor requires a SOC report, but systematic evaluation ensures you focus resources where they matter most. By understanding the vendor relationship, assessing risk exposure and evaluating assurance needs, organizations can make informed decisions about when to request these valuable but resource-intensive reports.

The goal isn't to demand SOC reports from every partner. It's to ensure that vendors handling your most sensitive data and critical operations maintain controls worthy of the trust you've placed in them.

Need help determining which vendors require SOC reports? Unsure whether the reports you're receiving meet your compliance needs? The Moore Colson Risk Advisory Team can help you evaluate your vendor relationships and develop a risk-based approach to third-party oversight.