Your 2026 Payroll May Have 27 Pay Periods: Here’s What That Means

You’re reviewing your company’s 2026 payroll calendar when you notice something unusual, 27 pay periods instead of the standard 26.

Before panic sets in, know that the 27th payroll period anomaly happens roughly every 11 years, and with proper planning, it’s entirely manageable. If your first biweekly payroll is paid on January 2, 2026, you’ll experience this rare occurrence firsthand.

For payroll professionals, this anomaly presents unique challenges. For salaried employees, it can mean an unexpected change in their paychecks. Understanding how to navigate this situation is essential for effective financial planning.

WHY DOES THIS EXTRA PAYCHECK HAPPEN?

In a typical biweekly system, 26 pay periods equal 364 days (26 x 14), leaving one or two surplus days in a calendar year.

This discrepancy becomes significant when the first payday of the year falls on January 1st or 2nd, which shifts the final payday into the subsequent calendar year, resulting in a 27th paycheck. In 2026, the 27th payday falls on or around December 31st, and due to the New Year's Day bank holiday on Friday, January 1, 2027, the final paycheck shifts to Thursday, December 31, 2026.

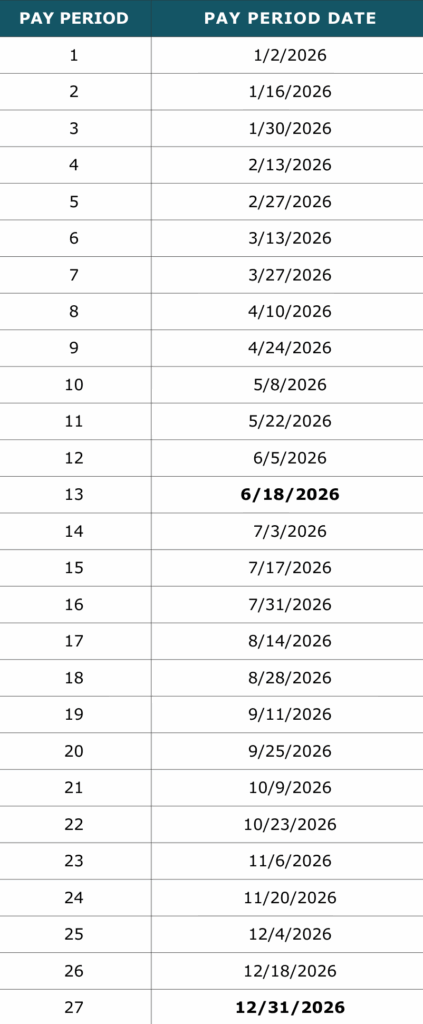

2026 Biweekly Payroll Cycles (Bold dates are Federal Holidays where payday moves back one day):

HOW SHOULD YOU HANDLE SALARIED EMPLOYEE PAY?

Employers typically use one of two strategies to address the complexities surrounding the 27th payroll cycle, each affecting employees’ biweekly pay differently.

Strategy #1. Pro-Rata Adjustment (Most Common Method)

Under this approach, employees retain their stated annual salary across the additional pay period, but their biweekly amount is recalculated.

- The Calculation: Annual salary is divided by 27 instead of 26

- The Result: Each of the 27 biweekly checks is slightly reduced

Example: An annual salary of $52,000 typically results in a biweekly paycheck of $2,000 ($52,000 ÷ 26). In a 27-paycheck year, the adjusted amount becomes approximately $1,925.93 ($52,000 ÷ 27).

Employer Insight: This method is financially prudent, maintaining the total salary expense constant. However, it requires clear communication with employees to explain why their paychecks are a lower amount throughout the year.

Strategy #2. “Pay As Usual” Approach (Employee-Favored Method)

This alternative simplifies payroll processing by keeping the biweekly paycheck amount consistent across all 27 periods without adjustment.

- The Calculation: The regular paycheck amount remains at annual salary divided by 26 for every pay period across the 27 weeks.

- The Result: Employees receive compensation exceeding their stated salary, effectively earning an additional two weeks of pay over the year.

Example: The $52,000 employee would continue receiving their normal $2,000 paycheck, totaling $54,000 for the year.

Employer Insight: While administratively simpler and often well-received by employees, this method leads to an increase in the company’s annual payout to salaried staff for that fiscal year, which could impact cash flow.

WHAT OTHER PAYROLL ISSUES SHOULD YOU WATCH FOR?

The challenges that come with the 27-paycheck year extend beyond adjustments in gross pay. They require careful administrative planning across several key areas:

- Benefit Deductions: Annual totals for benefits such as Health Insurance and Flexible Spending Accounts must remain intact.

Solution: Adjustments to deductions may be necessary on the first 26 checks to ensure compliance with annual obligations, or the final paycheck may have no deductions.

- 401(k) Retirement Contributions: Employees contributing a percentage of their pay to 401(k) plans risk exceeding IRS annual contribution limits prematurely because of the additional paycheck.

Solution: Payroll systems should be closely monitored to halt 401(k) contributions once the limit is reached to avoid penalties.

- Tax Withholdings: Correct tax withholding calculations must be maintained across 27 periods. While IRS withholding tables typically accommodate this, employers need to ensure their payroll software is updated and configured properly for the extra period to prevent underwithholding.

How Does this Affect Hourly Employees?

For hourly (non-exempt) employees, the situation is more straightforward. Payroll is based directly on the hours worked, meaning if the 27th pay date coincides with work periods, employees will be compensated accordingly. Their overall annual compensation will automatically increase due to the additional paycheck.

WHAT'S THE BOTTOM LINE?

The 27th paycheck year doesn’t have to be stressful. With proper planning and open communication, you can turn this anomaly into a smooth operation. The key is getting ahead. Work with your payroll provider now to choose the strategy that works best for your organization, then clearly communicate the decision to your team before the fiscal year begins.

Need help preparing your payroll for 2026? Contact our Outsourced Accounting Team. Whether you’re deciding between pro-rata adjustments or the pay-as-usual approach, or you want to ensure your benefits and tax withholdings stay compliant, we’re here to guide you through every step.